Hydrocarbon demand is forecast to fall in the coming decades due to measures the Paris Agreement signee governments will take to discourage emissions and ensure the success of net-zero goals. This agreement will render conventional oil and gas activity less and less viable, says GlobalData, noting that in order to reduce emissions and minimise losses, oil and gas companies should adopt measures such as carbon pricing by altering processes across the value chain.

GlobalData’s latest report, ESG (Environmental, Social, and Governance) in Oil and Gas – Thematic Research, reveals that technological innovation and increased consumer mindfulness will make sustainable alternatives to hydrocarbon-intensive products more and more attractive. For example, in transport, historically the largest hydrocarbon-demanding sector, conventional cars will be displaced almost entirely by electric vehicles (EVs).

George Monaghan, Oil and Gas Analyst at GlobalData, comments: “Though some demand will remain, survival for most current oil and gas companies will mean transitioning to a new product. While there are many options for products, with renewable energy being the most popular, companies will only succeed if they invest while demand is there to capitalise on already strong cash flows by the time demand falls. Companies that wait until hydrocarbon revenues dry up will have insufficient cash to fund a transition.”

GlobalData highlights that oil and gas companies will need effective governance to steer themselves through the existential disruption that the next three or four decades will bring.

A balancing act will be necessary: meeting net-zero objectives while retaining scale demands deft leadership. For example, companies must sustain sufficient cashflows to handle demand volatility, overhaul their asset portfolios, make astute investments, and satisfy sustainability-minded stakeholders, all while providing stable dividends.

Mr Monaghan continues: “As millennials come to dominate the consumer base and workforce and begin to assert their preferences, companies that fail to maintain good social practices (toward workers and affected local communities) will struggle to attract and retain customers and employees.”

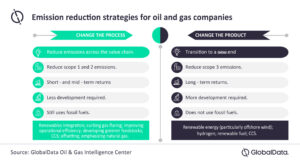

GlobalData states that the emission reduction strategies available to oil and gas companies can be divided into two broad approaches: change the process and change the product.

The company says that it is easy but unwise to underestimate the effectiveness of the ‘change the process’ approach. This approach involves multiple small and unglamorous changes but can deliver significant emission reductions.

At the same time, meeting 2040 or 2050 net-zero goals and dealing with the increasing unavailability of hydrocarbon reserves will require companies to change the product.

Mr Monaghan states: “Scope 1 and 2 emissions represent the majority of emissions for which the oil and gas industry is responsible. These emissions can be reduced by altering value chain practices. Since the end product is unchanged, this ‘change the process’ approach requires less R&D and infrastructural investment. It promises short- and mid-term returns.”

“However, other emissions are inextricable from oil and gas, particularly those produced by end-user combustion of the hydrocarbons (termed scope 3). Technological innovations may reduce the carbon content of the end-product, but practically, so long as the end-product is oil and gas, the company producing it will be responsible for significant scope emissions. To eliminate these emissions, companies must transition to a new end-product. This is the ‘change the product’ approach.”