Amidst the growing pressure from investors, customers and the workforce, oil and gas operators will continue to play a pivotal role in powering the world for decades to come. Despite this, a new report has found many existing companies may not survive the existential threat of global decarbonisation and climate change, with the possibility of the global energy system shifting away from fossil fuels faster than anticipated.

The latest State of Play report, Fuelling the Future: What’s next for Oil and Gas?, looks at four external scenarios and four business strategies based on oil and gas companies grappling with decarbonisation pressures and future energy demands. This includes a pivot to clean energy, as well as examining whether the best strategy for operators is to remain true to the core DNA of their business and the industry as oil and gas producers.

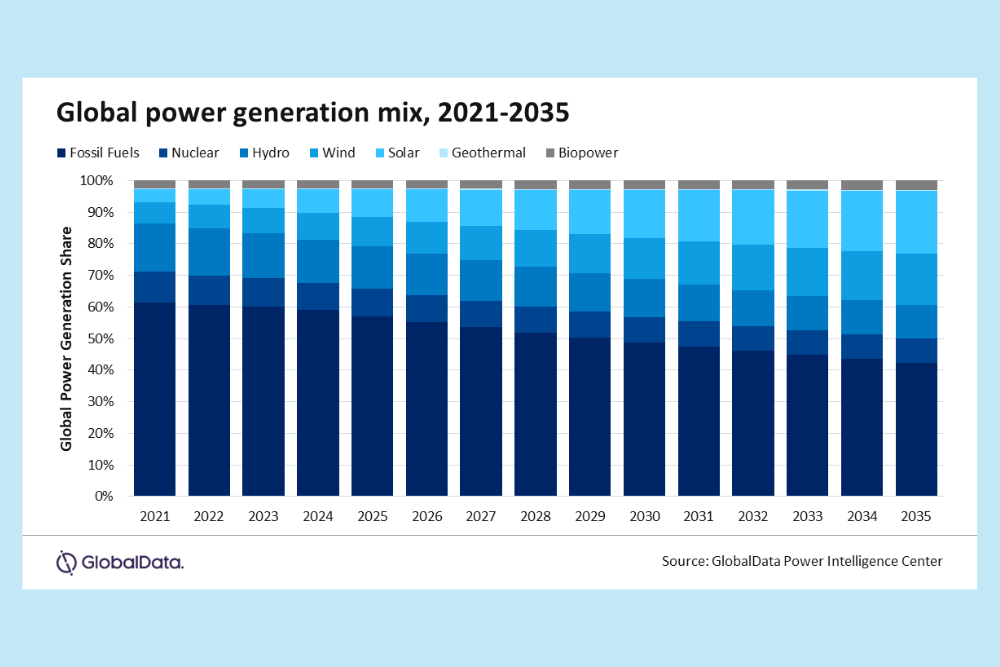

Regardless of the approach operators choose, the industry will continue to be impacted by several key trends, with renewable energy and electrification (74%), socially responsible investment (52%) and talent attraction and retention (33%) predicted to have some of the largest impacts on the industry over the next 15 years.

The report breaks down the core business model approach for the potential strategies. This includes addressing the role of carbon capture and storage, the viability of hydrogen at scale and the enablers required for a renewable, electrified future. Exclusive modelling undertaken by State of Play also unpacks three fuel alternatives at current prices to demonstrate the price differential between natural gas, blue hydrogen, and green hydrogen.

State of Play Chair Graeme Stanway says, “Decisions made today will impact the industry in decades to come. Oil and gas companies are faced with a slew of external forces and deciding on a strategy to address these will be critical to their survival.”

The success of these strategies will be determined factors including geopolitics and international capital flows. The data shows that majority of oil and gas executives feel policy and regulation (65%) is the best way government can intervene to support innovation in the industry. Community sentiment and sustainability requirements are also playing a role in the flow of funds.

“As investor pressure rises, the oil and gas industry will need to address the question of how to deal with public sentiment driving investment decisions, rather than solely profit. We are hearing from industry, however, that whilst some banks have a strong ESG focus, there are many out there still willing to fund oil and gas projects,” Mr Stanway says.

The report states that the renewables market is saturated with existing players and presents radically different requirements compared to oil and gas extraction and transportation.

While hydrogen could match existing engineering capabilities and legacy infrastructure with new energy generation methods, it is in a race with other storage and fuel mechanisms to prove economic viability at scale.

Meanwhile, CCUS represents the least disruption for existing methods yet is a mature idea without mature technology.

“None of these options are easy, all will require significant, bold investments matched with remarkable innovation leadership,” the report states.