Rystad Energy’s Senior Vice President, Jorge León, stated that the future of Venezuela’s oil industry remains uncertain as the deadline for US sanctions relief on Venezuela ends on April 18, 2024. The potential outcomes hinge on whether the US decides to reimpose sanctions or keep them lifted.

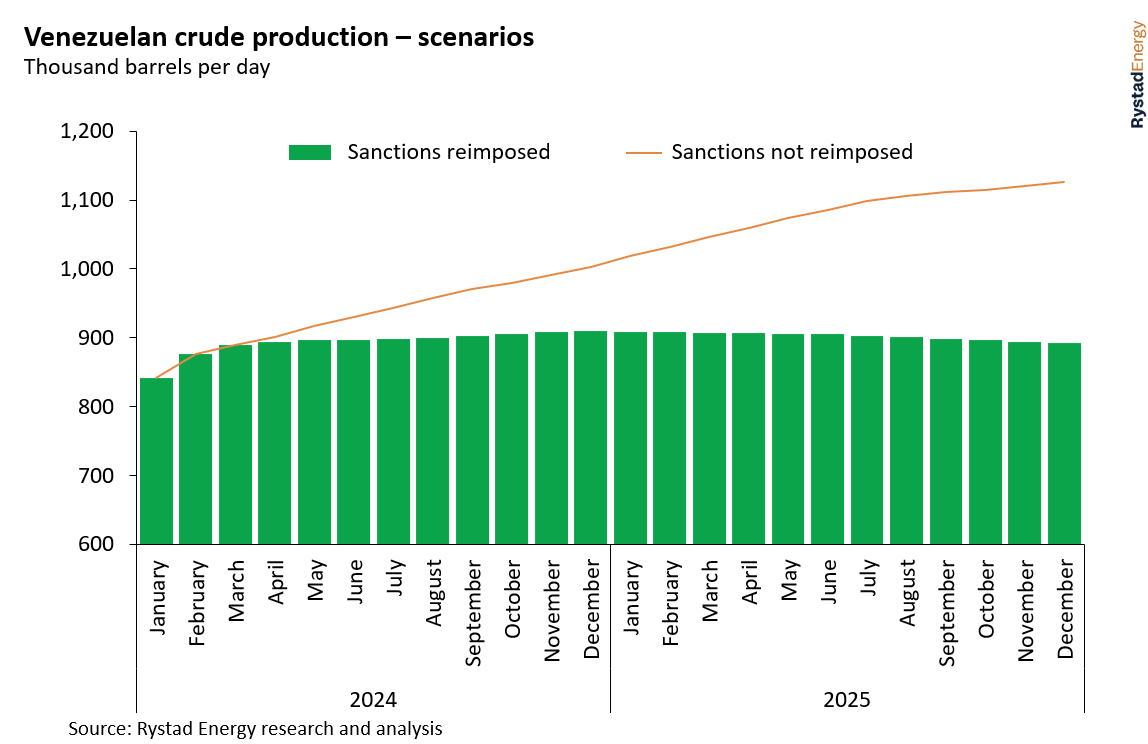

If sanctions are not reimposed, Venezuela could see its oil production surpass one million barrels per day (bpd) as early as December this year — reaching 1.12 million bpd by the end of 2025.

However, if sanctions are reinstated, production is expected to remain flat at around 890,000 bpd.

The decision regarding sanctions is complex, with arguments both for and against their reimposition.

The sanctions were initially lifted in exchange for the promise of fair and free, internationally-monitored elections in 2024.

While elections are scheduled for this year, there are concerns about their fairness, particularly after the leading opposition presidential candidate, Maria Corina Machado, was banned from standing for office by the country’s Supreme Court.

This move has raised questions about the legitimacy of the upcoming election.

Reimposing sanctions could be seen as a way to pressure Venezuela to hold a fair election, but it would also tighten the global oil market further, potentially raising oil and fuel prices for consumers.

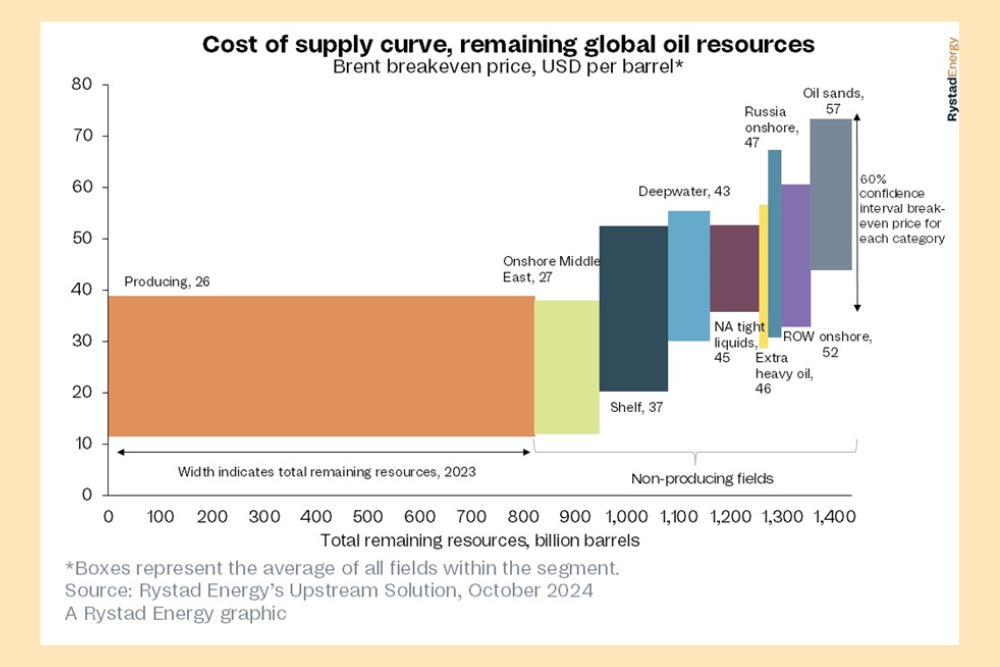

The market is already tight, especially in the heavy sour crude segment, which is the quality of most Venezuelan production.

The commissioning of the Olmeca refinery in Mexico and the Trans Mountain pipeline expansion project diverting Canadian barrels away from the US into Asia could further limit sour crude supply to the US.

Additionally, there are political considerations for the US, particularly concerning Hispanic voters.

While views on the sanctions among Venezuelans in the US are divided, re-imposing sanctions could have unintended consequences, including spurring a nationalist reaction in Venezuela in favour of President Maduro and exacerbating existing immigration issues faced by the US.

As things stand, the US appears more likely to keep sanctions lifted than to reimpose them.

However, there is speculation that the US could issue a cosmetic reversal of the sanctions that allows crude to flow out of the country but under different terms, such as selling in Venezuela’s national currency, the bolivar, through debt relief payments, instead of in US dollars.