Oil and gas contract activity remained relatively stable in Q1 2021, with the industry recording a marginal decrease in the number of contracts and at the same time an increase in disclosed contract value, according to GlobalData.

GlobalData’s latest report, ‘Q1 2021 Global Oil & Gas Industry Contracts Review’, notes that the number of oil and gas contracts declined while value increased with 1,330 in Q4 2020, with a value of $25.5 billion, as compared to 1,282 in Q1 2021, totalling $29.3 billion.

Oil & Gas Analyst at GlobalData, Pritam Kad, said: “Contract activity is now relatively stable with marginal improvement in crude oil price and the COVID-19 pandemic, the industry foresees a relatively stable outlook and capex improvement.”

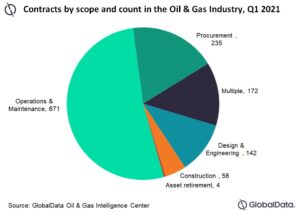

In Q1 2021, 52 per cent of the contracts recorded were for operations and maintenance (O&M) scope, followed by procurement scope with 18 per cent.

Some notable contracts include BW Offshore’s US$4.6 billion contract for Engineering, Procurement, Construction, Installation (EPCI), lease and operation of Barossa Floating Production, Storage and Offloading (FPSO), offshore of Darwin; and Arabian Industries and Special Technical Services’ US$4 billion contract from Petroleum Development Oman (PDO), spanning the execution of maintenance, integrity, field improvement proposals, turnaround activities, and the delivery of brownfield projects in the North and South of its concession area in Oman.