Global liquefied natural gas (LNG) trade increased to 360 million tonnes (Mt) in 2020, according to Shell’s latest annual LNG Outlook, despite the unprecedented volatility caused by the COVID-19 pandemic which resulted in lockdowns around the world.

Though marginal, the increase in volume reflects the resilience and flexibility of the global LNG market in 2020 – a year which saw losses to global GDP of several trillion dollars as economies large and small struggled to contain the COVID-19 outbreak. Demand in 2019 stood at 358 Mt.

Global LNG prices hit a record low early in the year but ended the 12-month period at a six-year high as demand in parts of Asia recovered and winter buying increased against tightened supply.

Maarten Wetselaar, Integrated Gas, Renewables and Energy Solutions Director at Shell said LNG provided flexible energy which the world needed during the COVID-19 pandemic, demonstrating its resilience and ability to power people’s lives in these unprecedented times.

“Around the world countries and companies, including Shell, are adopting net-zero emissions targets and seeking to create lower-carbon energy systems. As the cleanest-burning fossil fuel, natural gas and LNG have a central role to play in delivering the energy the world needs and helping power progress towards these targets,” he said.

Natural gas emits between 45 – 55 per cent fewer greenhouse gas emissions and less than one-tenth of the air pollutants than coal when used to generate electricity.

Demand rebounds in Asia

China and India led the recovery in demand for LNG following the outbreak of the pandemic. China increased its LNG imports by 7 Mt to 67 Mt, an 11 per cent increase for the year.

China’s target to become carbon neutral by 2060 is expected to continue driving up its LNG demand through the key role gas can play in decarbonising hard-to-abate sectors, namely buildings, heavy industry, shipping and heavy-duty road transport.

India increased imports by 11 per cent in 2020 as it took advantage of lower-priced LNG to supplement its domestic gas production.

Two other major Asian LNG-importing countries – Japan and South Korea – also announced net-zero emissions targets in 2020. To meet its net-zero target, South Korea aims to switch 24 coal-fired power plants to cleaner-burning LNG by 2034.

Demand in Europe, alongside flexible U.S. supply, helped to balance the global LNG market in the first half of 2020. However, supply outages in other basins, structural constraints and extreme weather later in the year resulted in higher prices.

LNG market to 2040

Overall, global LNG demand is estimated to hit 700 Mt by 2040. Asia is expected to drive nearly 75 per cent of this growth as domestic gas production declines and LNG substitutes higher emission energy sources, tackling air quality concerns and meeting emissions targets.

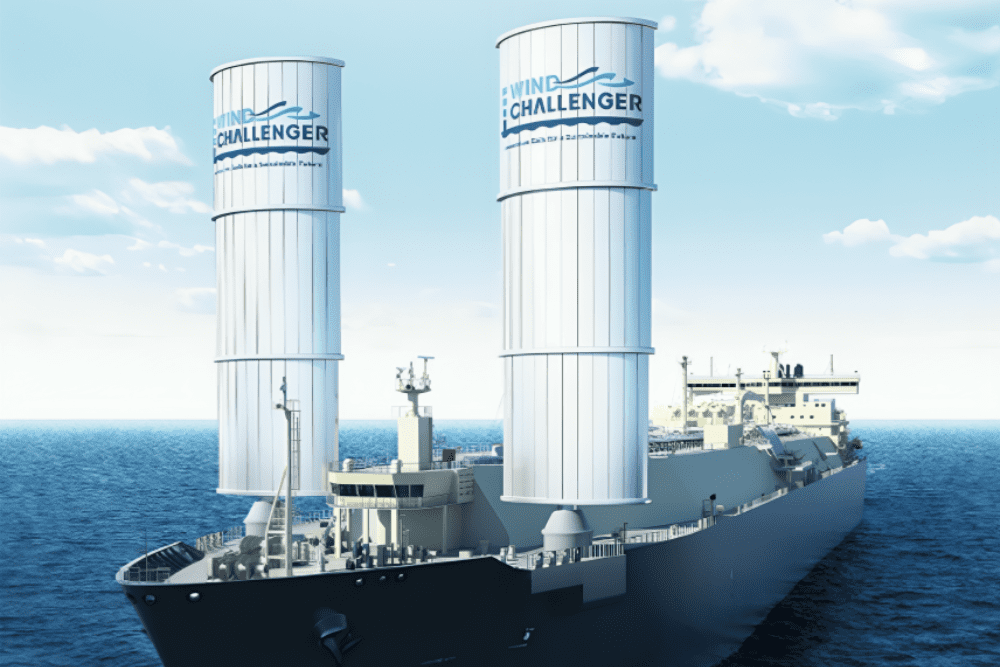

For instance, China’s heavy-duty transport sector consumed nearly 13 Mt of LNG in 2020, almost doubling from 2018, to serve the fast-growing fleet of well over 500,000 LNG-fuelled trucks and buses. LNG-fuelled shipping is also growing, with the number of vessels expected to more than double and global LNG bunkering vessels set to reach 45 by 2023.

As demand grows, a supply-demand gap is expected to open in the middle of the current decade with less new production coming on-stream than previously projected. Just 3 Mt in new LNG production capacity was announced in 2020, down from an expected 60 Mt.

According to estimates, more than half of future LNG demand will come from countries with net-zero emissions targets. The LNG industry will need to innovate at every stage of the value chain to lower emissions and play a key role in powering hard-to-abate sectors.

The Shell LNG Outlook 2021 can be found here.