APPEA says recent reports that Australia should be prepared for a similar price shock as that experienced in Europe are unfounded since the European and Australian gas markets are very different, and the circumstances that led to Europe’s current situation are not generally applicable to Australia, even under challenging conditions.

Europe has seen a 600 per cent surge in natural gas prices as demand for gas is increasing globally, with many countries around the world continuing to re-open following the lifting of COVID-19 restrictions and make winter preparations.

In Asia, demand has been driven by a combination of the increased need for space heating, continued rapid growth in China, and a desire to keep LNG storage tanks topped up throughout the summer.

And in South America, low hydroelectricity output and a slump in domestic gas production have likewise generated strong LNG demand, with an anticipated 5 per cent increase in available LNG export capacity offset by outages and feed gas issues at numerous plants.

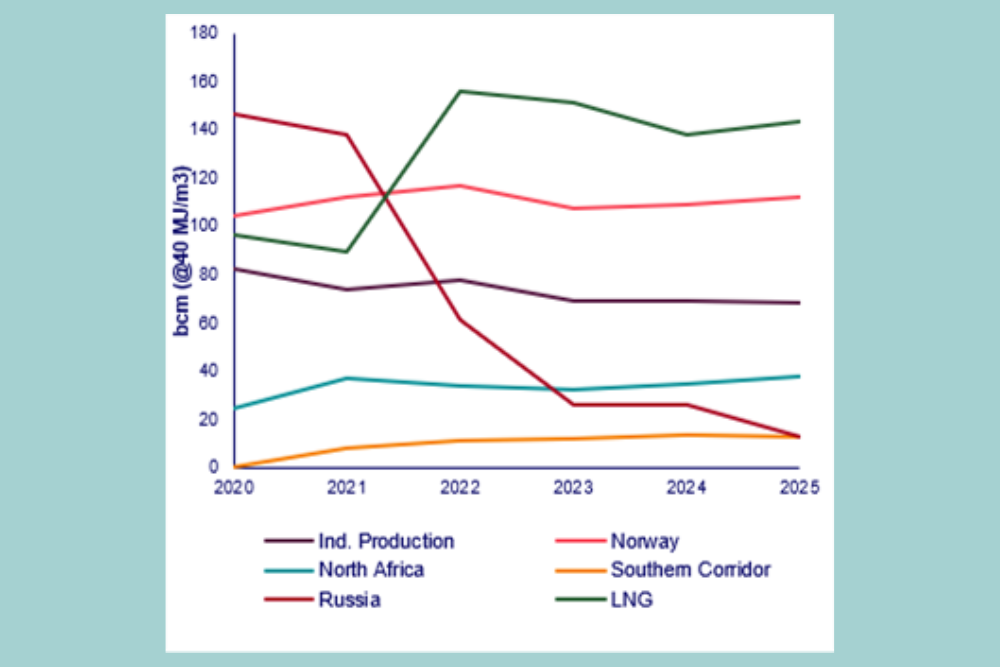

“These requirements have resulted in a significant tightening of global LNG supply markets which, when combined with local factors such as lower-than-average stock replenishment and pipeline imports, has left Europe with a relative shortage of gas, and led to financial difficulties for several energy producers,” APPEA notes.

Additionally, an ongoing continental shift away from ageing coal-fired, and — in some nations such as Belgium — nuclear power plants, has placed further pressures on gas suppliers to bridge the resultant energy gap, further driving up prices.

APPEA says that while supply influences prices, there are several factors that set Australia and Europe’s markets apart. For example, supply pressures are heightened in European markets in part due to its role as the global balancing market for LNG. Meanwhile, Australian gas prices are connected to international oil and gas prices, but local conditions play an important role in determining potential impacts and should not be ignored.

“For one thing, our nation enjoys considerable domestic production capacity when compared with most European countries, and therefore is not as reliant on external suppliers.”

Also, most Australian LNG contracts are traded under long-term contracts, and as such do not possess the volatility inherent to short-term markets.

“While short-term market movements can place some upward pressure on long-term Australian contract pricing over time (particularly Asian LNG spot prices), the truth remains that Australia’s preference for long-term contracts in combination with its domestic supply provides Australian exporters and customers with a significant level of security and stability not afforded to our European counterparts.”