According to a new report by Wood Mackenzie, gas prices in Europe could drop to as low as US$6.70 per million British thermal units (mmbtu) in the summer, as storage levels are expected to remain above 55 per cent due to the mild winter.

The report, titled Europe gas and power markets short-term outlook Q1 2024 notes that the mild European winter, the second in succession, will lead to European storage levels reaching 89 per cent by the end of July 2024, which will further push prices down.

Wood Mackenzie Director of Europe Gas & LNG Markets Mauro Chavez explains: “With storage levels nearing full capacity towards the end of the summer, there will be up to 10 bcm of excess supply that will need to either be piped into underground storage facilities in Ukraine or floated in LNG vessels.”

This surplus supply will require a higher summer-winter differential to balance the market, compared to what the current forward curve suggests, putting downward pressure on Q3 prices.

The report also highlights that European gas demand is rebounding under normal weather and improved economic performance.

While gas demand remained suppressed in 2023, falling 16 per cent versus the five-year average, 2024 has started strong with colder weather supporting distribution demand. Industrial demand has also maintained its recovery trend, increasing 12 per cent year-on-year in January and around 6 per cent in February.

The forecast for 2024 indicates that household gas demand in Europe is expected to rise by 12 billion cubic metres (bcm) under normal weather conditions, while industrial demand will increase by 5.5 bcm as the EU economy rebounds in the second half of the year.

However, 9 bcm less gas will go into power generation, reducing the impact of residential and industrial demand growth. Overall, European demand is set to increase by 9 bcm.

Looking ahead to 2025, European prices are expected to increase.

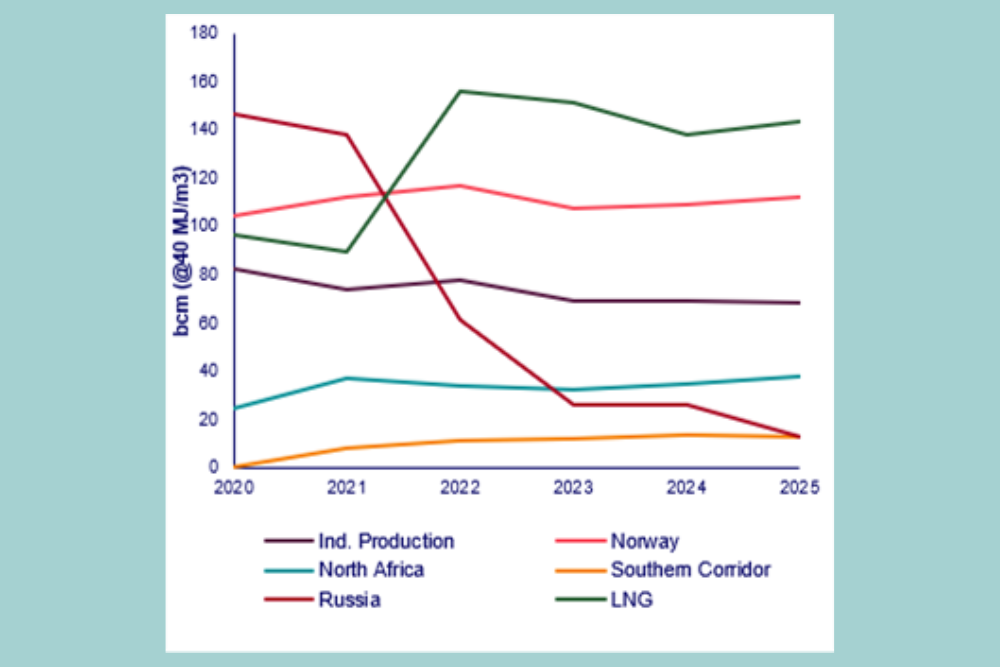

Despite new LNG supply being commissioned in 2024 and 2025, LNG year-on-year supply growth will be limited to 15 mmtpa in 2025, as projects will take time to ramp up and some legacy LNG supply will continue to decline.

Therefore, LNG imports to Europe are projected to increase by only 4.5 mmtpa in 2025.

The report concludes that Russian gas flows through Ukraine will be a key dynamic to watch in 2025.

If the end of the transit agreement between Russia and Ukraine results in a complete stop of flows, then Europe could see storage levels limited to 93 per cent by the end of summer 2025, providing an upside to prices.

However, if an agreement is found to transit flows through Ukraine, then European prices would come under more pressure.