Companies look to navigate windfalls and inflation, responsibly increase investment, decarbonise and develop new gas business models, according to the recently released report ‘Global upstream: 5 thingds to look for in 2023’ from Wood Mackenzie.

Upstream oil and gas companies made big strides in 2022, restoring confidence and repairing balance sheets.

But the challenges the industry faces will compound in 2023.

Windfalls and incentives

Country risk has risen toward the top of the pile of investor considerations.

If prices move higher, more countries will take action in the form of price caps or windfall taxes.

Operators will have to reassess current and new opportunities, even in countries previously thought to be low-risk.

“We will see many different approaches, from windfall taxes to relieve pressure on public finances, to incentives which accelerate oil and gas potential” said Fraser McKay, Head of Upstream Analysis at Wood Mackenzie.

“Many of these actions will begin to reflect the energy transition aspirations of host governments.

“We advocate smart policies which provide both fairness and predictability, regardless of the prevailing price.”

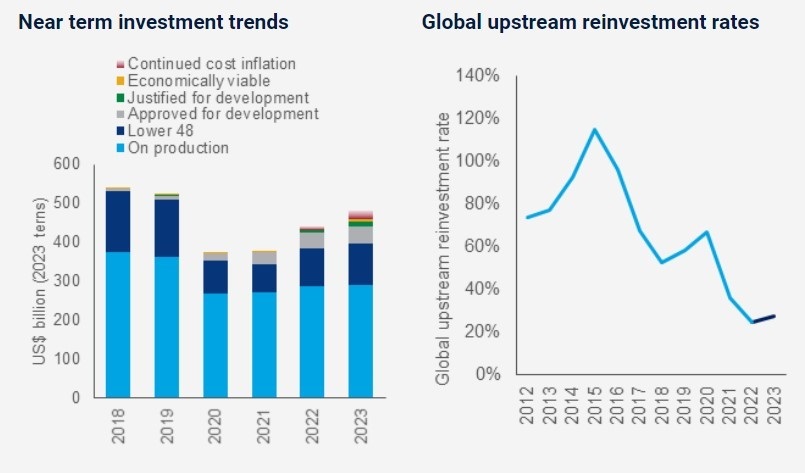

Restrained investment growth

Industry cash flow will fall 9% to US$1.3 trillion in 2023, while reinvestment rates (investment divided by operating cash flow) will rebound to 28%, up from an all-time low of 24% in 2022.

Development spending will increase as well, up at least 10% to between US$460 billion and US$480 billion.

McKay said: “Investment needs to rise further in 2023 and subsequent years if supply shortages are to be avoided.

“But not by as much or for as long as many market observers think.

“And with corporate deleveraging largely complete, there is room for both incremental reinvestment and continued shareholder distributions.

“Who increases spend, where and by how much will be a much debated topic in 2023.”

Cost inflation will constrain the impact of spend increases, and supply chain bottlenecks and inefficiencies will threaten the hard-fought gains made through previous downturns.

Around half the global increase in spend will be consumed by widening supply chain margins.

Decarbonisation at the core of Upstream 2.0

Governments and NOCs in the main producing countries will try to marry low-carbon credentials with increasing upstream investment in 2023.

IOCs looking to be part of Upstream 2.0 will need to demonstrate and disclose further emissions reductions.

McKay stated: “Regulations will compel companies to invest in measurement, monitoring and mitigation.

“Those that have already tackled the low hanging fruit will need to dig deeper – electrification and grid connection where it’s possible, dedicated renewables where it’s not.

“By the end of 2023 it will be extremely hard for mainstream operators to sanction projects without emissions mitigation plans.”

Gas business models will start to change

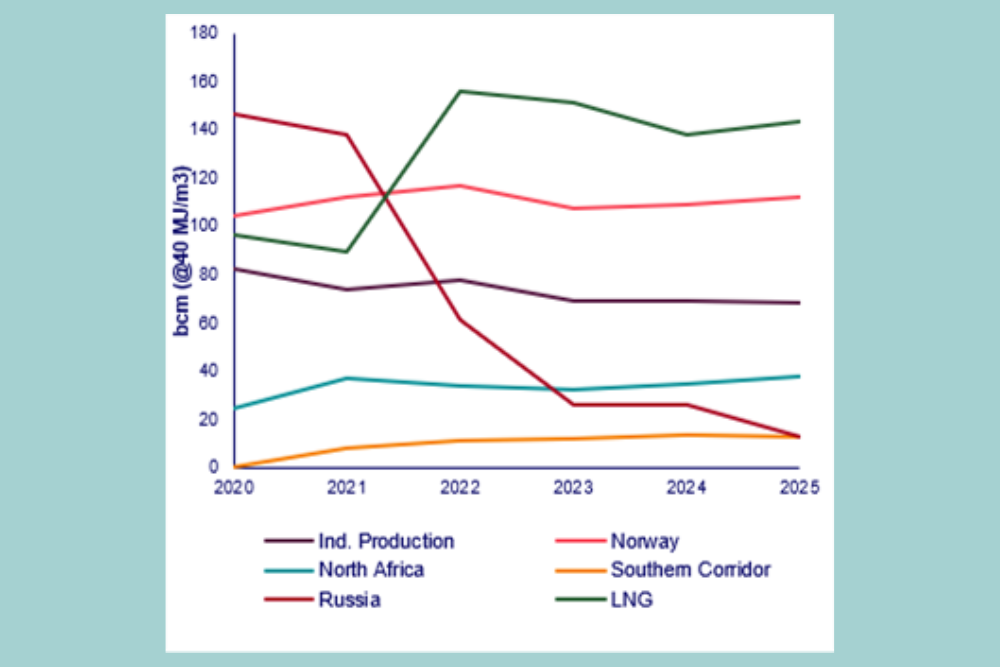

The European gas crisis triggered price spreads that will make upstream operators reassess their gas business models.

Near-term investment will focus on raising domestic European production and new development concepts to unlock stranded gas.

“We won’t see the industry spending more on gas than oil this year, but it’s clear that gas remains investible and will play an important role for upstream companies moving forward,” said McKay.

“This year, operators will focus on making gas project returns more competitive with oil, while evaluating CCUS for high CO2 content fields and even blue hydrogen concepts.”