Today, the German gas transmission system operators (TSOs) presented their draft Gas Network Development Plan 2022-2032, which reflects the fundamental shift in Germany’s energy supply.

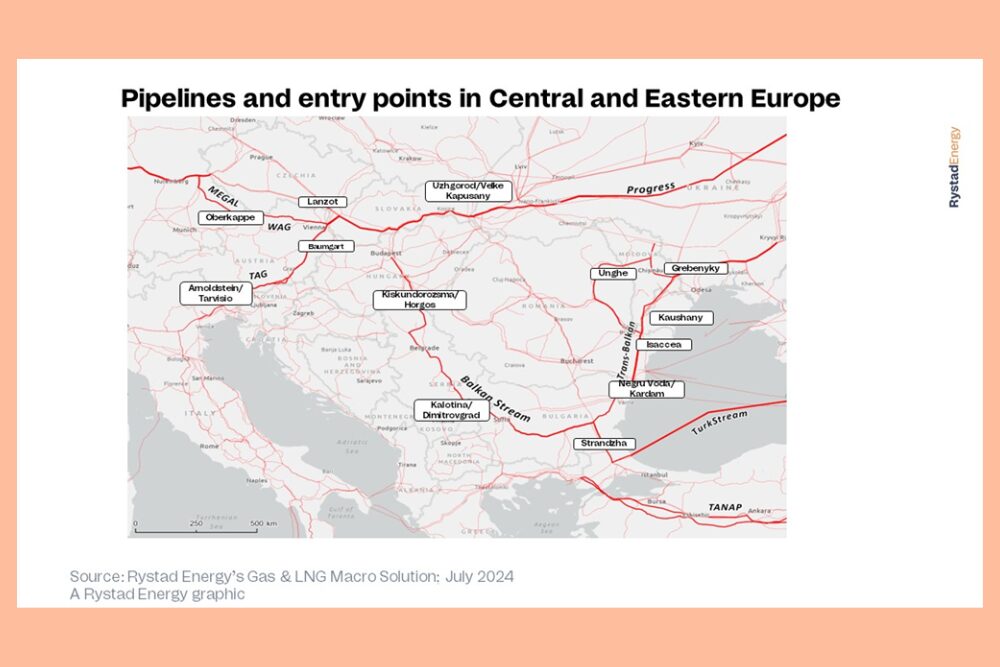

The proposal is designed to facilitate the changes needed for the network to accommodate the new LNG supplies into Germany and Europe and allow greater use of western import routes while also reflecting reduced gas demand as well as efforts to switch to hydrogen with a view to making Germany fully independent of Russian gas.

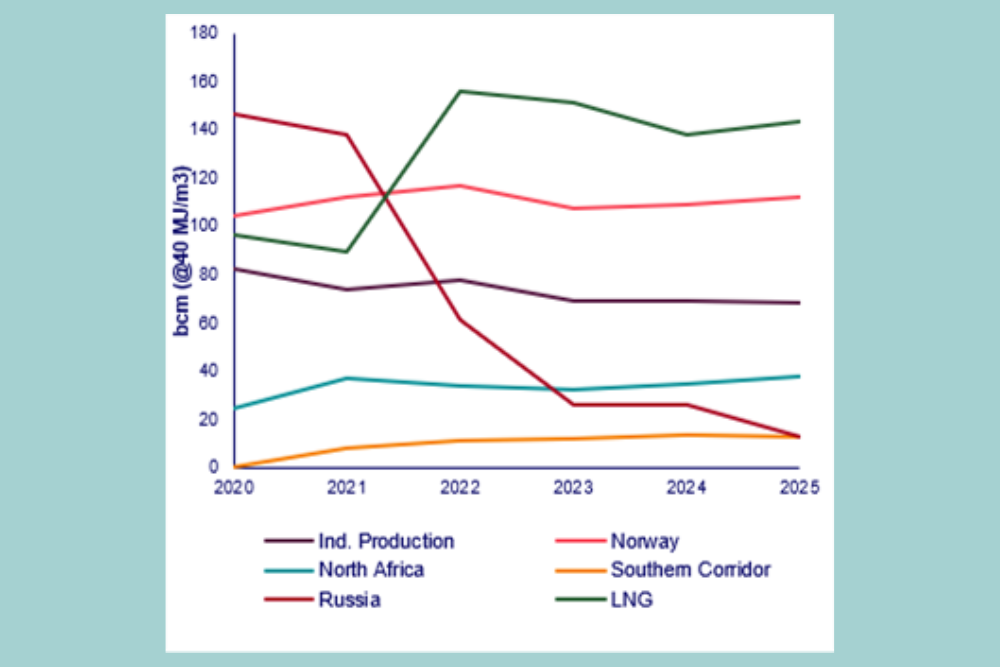

Gas consumption in Germany is expected to decline by at least 20 per cent by 2032. However, this alone will not suffice to restore the supply/demand balance, which is why Russian gas is to be replaced primarily by LNG. These are the main parameters of the draft Gas Network Development Plan 2022- 2032 presented today by the TSOs. According to their calculations, the proposed projects will require some 4.4 billion euros (AU$7.1 billion) of investment, 1.9 billion of which will be network expansion projects for new LNG.

After the warm weather, the extensive use of redundant infrastructure and a reduction in gas demand helped to ensure security of supply during the last heating season, the task now is to make the transmission network more resilient to the changes facing the gas industry while at the same time gaining independence from Russian gas and increasing the diversification of import sources.

FNB Gas Chairman Dr Thomas Gößmann said a reliable energy supply is an absolute must for the people in Germany and for the country’s competitiveness as industrial location.

“That is why we have been working flat out since the start of Russia’s war of aggression on Ukraine to adapt our network to the massive changes in the geopolitical and energy industry landscape.”

The TSOs have proposed the LNGplus C variant for the envisaged network expansion. The gas infrastructure underlying this variant offers flexibility between LNG capacity expansion projects focussing on the German North Sea and Baltic Sea coasts (as in variant B) and the option to import more gas from neighbouring Western European countries.

FNB Gas Managing Director Inga Posch said at this point in time, it is still open which capacities will actually be built at the German LNG sites.

“At the same time, neighbouring network operators have indicated that they are able to make additional capacities available at the cross-border interconnection points. It makes sense to use these access points to LNG facilities in Western Europe to maximise availability and flexibility as soon as possible.”

The draft document also contains an analysis of which gas transmission pipelines could potentially be repurposed for hydrogen by 2027 and thus become part of the proposed hydrogen network presented in July 2022. According to the analysis, three quarters of the roughly 2,000 km of gas pipelines in question could be converted to hydrogen without natural gas reinforcement measures. Given the continued absence of a legal basis, projects to establish a hydrogen transmission network are neither part of the expansion proposal nor are they included in the capex estimate.

Dr Gößmann noted the economic potential for hydrogen is huge.

“Policymakers do not have to reinvent the wheel to enable the decarbonisation of industry right now. Natural gas and hydrogen have so much in common that we can continue to use existing structures and processes easily and efficiently. Time-consuming discussions about the pros and cons of a new network company won’t get us anywhere.”