Carnarvon Petroleum Limited announced today that all completion requirements have been met for the Buffalo farm-out. The Buffalo-10 well is on track to be drilled in late 2021, subject to securing a drilling rig, where the tendering process is already underway.

On 17 December 2020, Carnarvon advised that Advance Energy plc will acquire 50 per cent of the Buffalo project by funding the drilling of the Buffalo-10 well up to US$20 million on a free carry basis. Advance has met this funding requirement and now has a 50 per cent interest in the project. The joint venture will acquire development funding from third-party lenders and any additional funding requirements (in addition to that provided by third-party lenders) will be provided by Advance as an interest-free loan.

Carnarvon Managing Director and CEO, Adrian Cook, said the completion of the transaction is fantastic news and they look forward to drilling the Buffalo-10 well later in the year.

“The joint venture will move to develop the field quickly to take advantage of the strengthening oil markets. This will be achieved by suspending the well as a future production well and commencing early development studies during 2021,” he said.

“The Buffalo field has the advantage of being in shallow water which enables a low-cost project. This together with the certainty of the fields historical production characteristics enables a fast track timetable and makes Buffalo an exciting project for Carnarvon shareholders.”

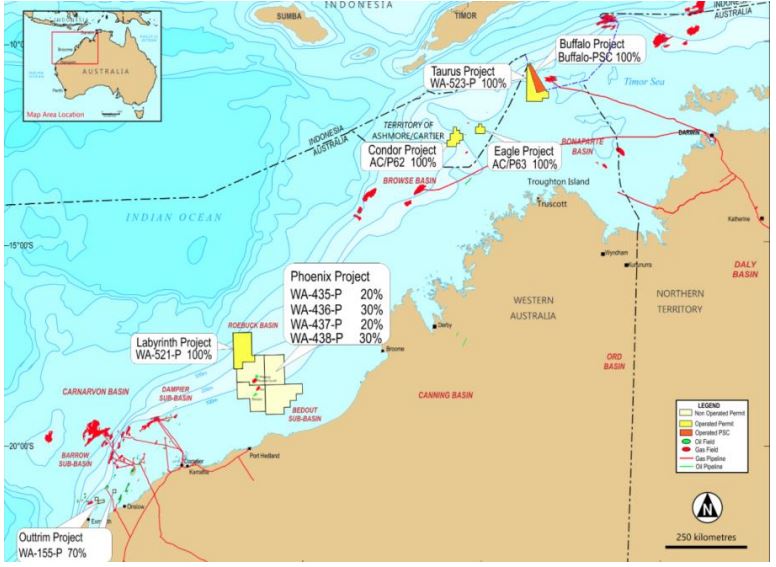

Located offshore of Timor-Leste in the Bonaparte Basin, the Buffalo oil field produced 20.6 million barrels of oil from December 1999 to November 2005 under the operatorship of BHP, followed by Nexen. The field was producing 4,000 barrels of oil per day prior to being decommissioning.

Carnarvon was awarded the WA-523-P permit, which included the previously developed Buffalo field, in May 2016 for an initial six-year term. All existing facilities and wells were decommissioned and removed prior to Carnarvon being awarded the permit.

Carnarvon initially focused its technical work on reprocessing of the 3D seismic dataset using state-of-the-art full waveform inversion (FWI) technology. This work supports the interpretation of a significant attic oil accumulation remaining after the original development, based on sub-optimal positioning of early wells using poorly processed seismic data.

Carnarvon outlines that reservoir modelling has been conducted using the latest structural interpretation and available well data, including an extensive history-matching effort to calibrate model/well performance to production rates and water-cut development (governed by strong aquifer drive) observed during the original production period.

Based on this work, independently audited volumetric estimates of contingent resources in the Buffalo oil field are 31.1 million barrels (2C) with low estimates of 15.3 million barrels (1C) and high estimates of 47.8 million barrels (3C) [1].

[1] Refer to Carnarvon Petroleum’s ASX announcement on 28 August 2017.