Strong demand for gasoline in Europe and the US is having unprecedented impacts on Europe’s petrochemical markets, according to Independent Commodity Intelligence Services (ICIS).

ICIS petrochemical markets reporter Miguel Rodriguez Fernandez writes:

Strong gasoline demand in Europe and the US has pulled aromatics feedstocks into the gasoline blend pool and left extraction of some chemicals uneconomical as margin pressure risks reaching breaking point.

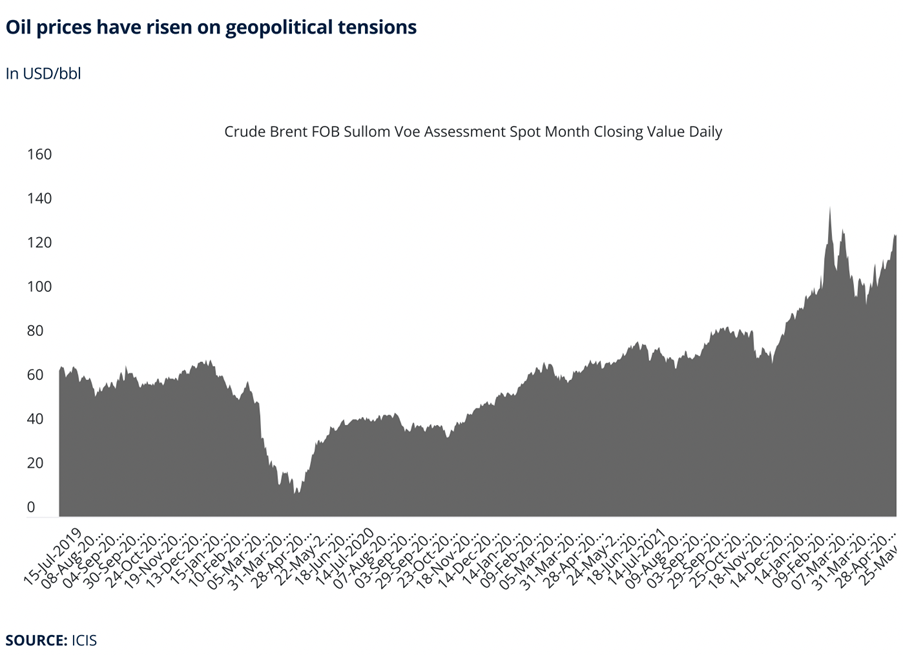

Europe gasoline prices have climbed to their highest levels in history on the back of a strong summer driving season that follows several years of lockdowns.

Reduced US capacity and sanctions on Russian imports have put an extra squeeze on supply.

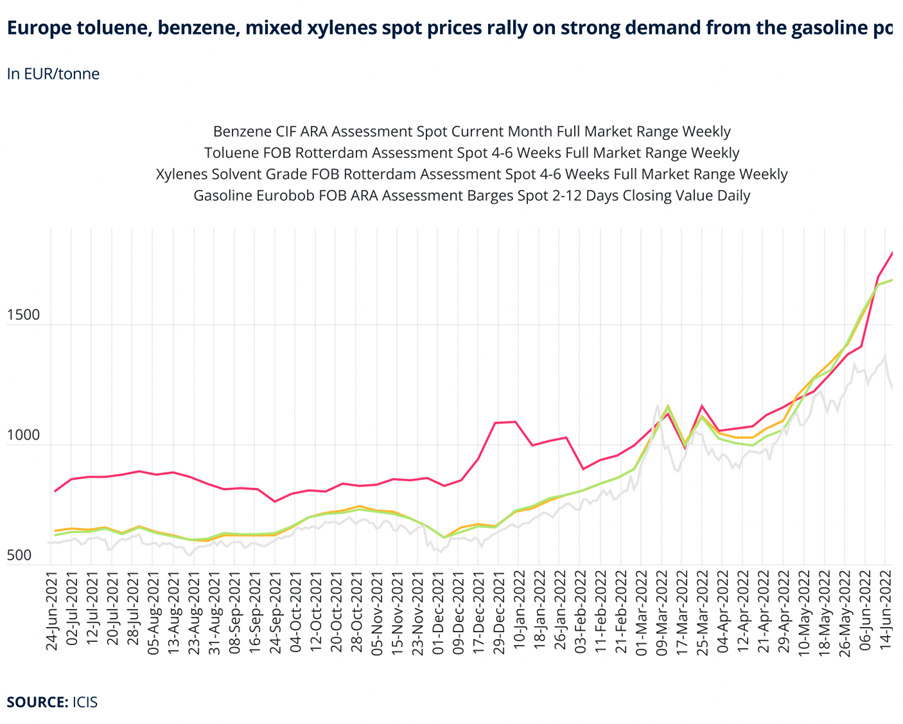

With the naphtha-gasoline spread at record levels, gasoline blending has been an obvious choice for the industry, but the resulting shortfall in feedstock left for chemicals extraction has already rocketed spot prices of toluene and benzene to record levels in recent weeks.

Premium octane blendstocks like toluene, mixed xylenes (MX) and ethylbenzene (EB) are also in high demand as blenders are using more low-octane naphtha in the gasoline pool because of a lack of viable alternatives.

Chemicals extractors are also facing the prospect of hiking natural gas costs, which have again jumped in recent days on the back of Russia sanctions, following a record spike earlier this year.

Players in derivative markets like styrene, paraxylene (PX) now face the question of how to manage these upstream cost hikes, with production cuts expected in some cases, and brace themselves for tumultuous contract price negotiations this summer.

Tight toluene and MX markets

Although gasoline blending demand from the US is the major reason behind the vigorous European bulk spot market for toluene and MX, buying interest from the European gasoline blenders have also increased recently after staying soft for relatively a long period.

Chemical downstream demand for both products is brittle mainly linked with profitability issues, even though there are tight market conditions for some products, such as orthoxylene (OX).

Overall demand is expected to remain stable supported by healthy interests from the gasoline blending sector.

Supply of toluene and MX continues to be tight because of a number or reasons including profitability and maintenance.

Availability constraints are also expected to continue in the short term.

Some of this has resulted in spot premiums over Eurobob gasoline prices reaching high levels.

Toluene and MX spot prices in June are at the highest levels since ICIS assessments began.

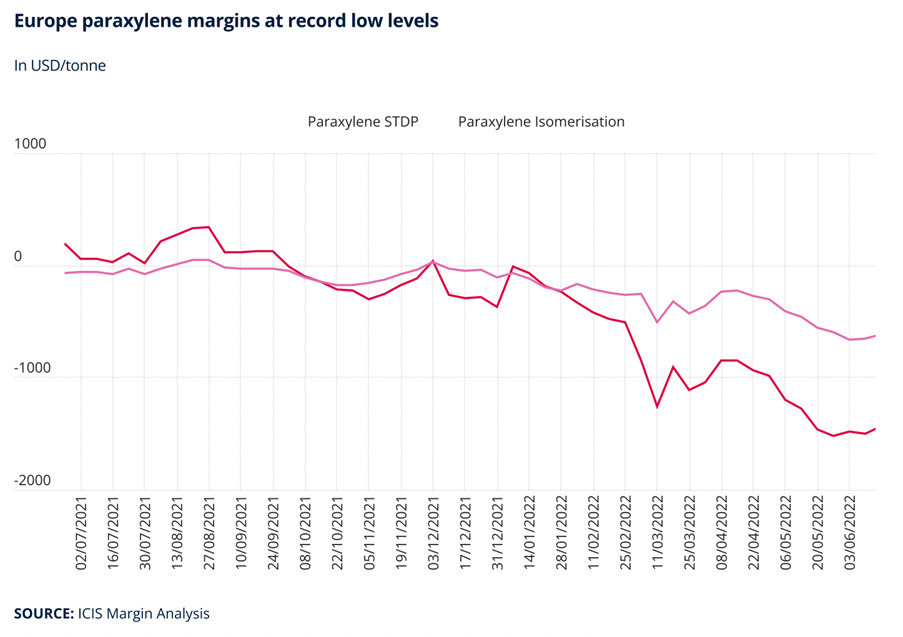

Rising MX costs are having direct impact on the downstream PX market, where European producers face unprecedented negative profit margins, according to ICIS margins data.

PX players are bracing for complicated negotiations in June and July, as producers claim PX contract prices should not be lower than what gasoline blenders are currently paying for MX.

PX buyers’ position, however, is different.

One PX buyer said: “PX prices cannot be set by the seasonal surge from the gasoline pool.

“The purified terephthalic acid (PTA) and polyethylene terephthalate (PET) markets are the traditional consumers of PX and we cannot afford such a big increase.

“It would be the death of the industry.”

A bullish gasoline blending market is also likely to encourage blenders to increase spot methyl tertiary-butyl ether (MTBE) purchases.

Production margins will depend on business activity going on in the methanol and energy market.

Biofuel mandate cuts to add more pressure

Additional pressure on MTBE and other blending components such as MX and toluene could come from the biofuel market, as discussions about biofuel mandate cuts in Europe could potentially increase demand for fossil fuel-based alternatives in the remainder of the year and 2023.

Impacts of the war in Ukraine have left the European biofuel market with a chronic shortage of bio-feedstock, with wheat, corn, rapeseed, and sunflower oil supply in Europe hitting alarming low levels and record-high prices in Q2.

Several biofuel-consuming countries in Europe are essentially looking to reduce mandates to address high fuel costs that arose due to a lack of Russian oil flow to European refineries.

Finland, the Czech Republic, Latvia and Croatia have already reduced mandates until 2023.

Gasoline demand to remain high over summer

Gasoline demand is expected to continue to march higher throughout the summer, primarily supported by the travel season in Europe.

A particularly strong driving season in the US will also lead to further demand for European gasoline exports into the North America region.

ICIS senior analyst Ajay Parmar expects blending demand for certain gasoline components to face pressure in the near term – high octane blending components such as MTBE are highly priced at present and therefore gasoline blenders are reducing the amount of this component into their blends.

Blending demand for counter-components such as naphtha have therefore also reduced, leading to a collapse in naphtha cracks into strongly negative territory.

Parmar predicts crude oil prices to breach US$130 a barrel in July, which will eventually lead to some overall oil demand destruction.

That circumstance, added to the summer driving season ending, is likely to lead to reduction in buying interest for gasoline in quarter four.