Societal lockdown, economic recession and tumbling oil prices are all testing new floors for LNG prices.

The speed of the oil price collapse following the OPEC+ meeting on 6 March was as unexpected as it was unprecedented. The result has been a month of mayhem. And this time it isn’t just a supply issue, as coronavirus leads us into global recession with huge uncertainty around the timing and shape of future demand recovery. With output rising and storage reaching capacity, negative crude prices are a real possibility.

The story for natural gas prices is somewhat different. The fall in spot LNG prices had been anticipated for some time. Northeast Asian spot prices in September last year were already 60 per cent lower than the same month in 2018. Growth in new supply and weakening Asian demand, particularly in China, were pushing prices towards US production breakevens long before the coronavirus outbreak and its attendant consequences.

But what we have seen since has been surreal. Already oversupplied, the global LNG market has come out of a mild winter straight into the headlock of a global pandemic that is impacting demand across the world’s major gas markets as rapidly as it is damaging their economies. As fundamentals continue to weaken, just how low could spot LNG prices fall?

The scale of the problem

Delivered Northeast Asian LNG prices entered winter under US$5/mmbtu, tumbling further as the impact from coronavirus was gradually understood. And while coronavirus has dominated the headlines, weakening gas demand has only served to reinforce the fundamentals of LNG oversupply.

All this has pushed delivered prices into Northeastern Asia today below US$2.40/mmbtu and an increasingly saturated European gas market has sunk TTF prices under US$2.30/mmbtu. Modest indications of both economic and gas demand recovery in China are providing a glimmer of hope, but elsewhere it’s a grim picture. Strict containment measures remain in place across Europe as recorded cases rise and economies judder to a halt. Japan will potentially declare a state of emergency as early as today in Tokyo and six other regions. India’s nationwide lockdown is choking energy consumption and raising fears of a humanitarian crisis.

US supply now the focus

This leaves us looking to a dial-down in US Gulf coast production as the last mechanism supporting some form of market rebalancing. The data supports the argument that this should be happening more, but to date, US LNG liquefaction utilisation has been robust despite the economics of much US supply not being supported by European or Asian gas prices.

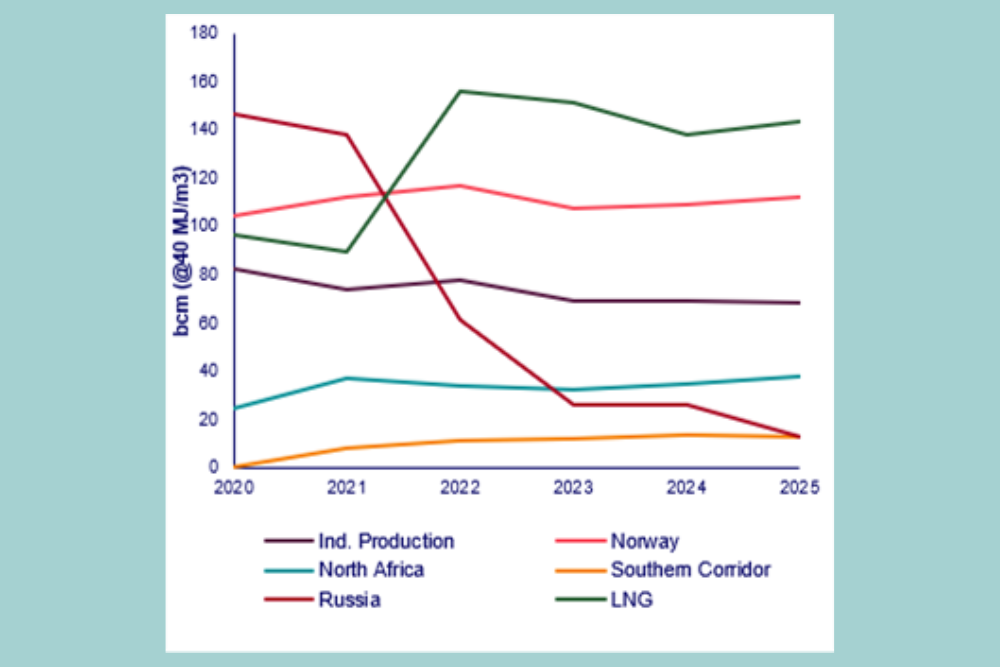

The key to understanding this is the light grey area in the chart above. Any US LNG delivered into Europe this summer in this cost band is bleeding cash. With US output still rising, let’s assume hedging is off the chart right now. But how long can this last in the current market (and how much has it cost)?

Even the most efficient liquefaction plant in the US cannot support a negative spread between feedgas costs – highly correlated to Henry Hub – and FOB LNG prices (currently around US$1.60/mmbtu). Prices are now effectively being set by a netback from TTF; however, the discounts from on-the-water US LNG to accessing TTF have increased as utilisation of European terminals has grown. Imports into Northwest Europe in Q1 were close to 50 per cent higher than the same period in 2019. Any cargoes sold at this price level are effectively distressed.

Could Henry Hub fall further and push US liquefaction back into positive territory? Doubtful, as current prices are already below sustainable levels and US producers are cutting investment as both oil and gas prices slump. The likely loss of some associated US gas supply could hurt US LNG producers further, although the impact will only likely be felt by 2021 due to the delayed nature of drilling reductions.

What is the floor for the spot LNG price?

Even in ‘normal’ times, the market often overshoots or falls too far before a correction takes place. If Asian demand is fully met, then sellers need an alternative market. Right now, that’s Europe. And for sellers desperate for a netback even cargoes from as far as Australia may need to consider Europe as a destination (it’s happened before). How low could prices go? Think of it this way: LNG netbacks (FOB) are tending towards $0/mmbtu as Europe/US prices converge and Asia Pacific suppliers must look ever further to find a market.

When I asked my colleague Rob Sims from our short-term LNG team about this he was blunt in his assessment: “Demand has fallen too quickly and we have not yet seen a supply response. It’s basic supply and demand, Gavin”.

Can storage provide a floor?

To some extent in the short term, though capacity is limited. Buyers have already been taking advantage and building inventory for some time, both in Asia and in Europe. Indeed, Europe coming out of winter with record inventory levels will prolong oversupply as we lose the injection lever. Storage was key to US projects avoiding underutilisation last summer, kicking the can down the road to this summer.

Floating storage is another option but typically a last resort (or a bullish speculative play). We are seeing a significant increase in average voyage times starting in March and now gaining strength in April. However, the shipping fleet has its own issues as travel restrictions mean most vessels cannot offload crews to rotate for new ones – and nor do they want to, given the risk of picking up infected personnel.

Asian demand growth a critical pathway to recovery

The pace and shape of recovery in gas demand is now critical. Sooner or later, the world will start to grow again, because that’s what economies do. With low gas prices, European coal-to-gas switching will continue and is key to setting TTF prices, which in turn will determine Atlantic LNG prices and hence Asia Pacific prices.

We expect global LNG demand to grow by 6% year-on-year to 371 million tonnes in 2020, with Asia playing a key role. China’s LNG demand is expected to reach 65 Mt this year, equivalent to 6.6% growth year-on-year. Japan and South Korea will increase 5.1% and 7.7% versus 2019, respectively, with LNG displacing coal in the power sector of both countries. This growth could be faster still if a recovery takes hold earlier.

Low LNG prices are good news for Asian buyers and the wider population. The hope for the LNG industry is that economic recovery will now drive stronger demand and support prices that reflect the true cost of supply. At this current time, the path to recovery feels an uncharted voyage.