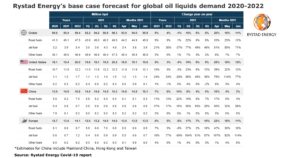

Rystad Energy’s latest COVID-19 report forecasts that global demand for road fuel will rise by 9 per cent in 2021. Below are some of Rystad’s other forecasts from the April 2021 report which considers developments that have occurred up to and including 15 April.

Global oil demand

Rystad’s latest forecast projects a 6 per cent year-on-year increase in oil demand in 2021, climbing to an average of 95.4 million barrels per day (bpd) from 89.6 million bpd in 2020.

The company’s estimates show that total oil demand in 2022 will continue to rise, reaching about 99.4 million bpd.

April 2021 demand is expected to land at 93.0 million bpd, climbing to 94.0 million bpd in May and 95.8 million bpd in June.

Further ahead, total oil demand in the third quarter is expected to average 96.8 million bpd before ascending to 98.3 million bpd in the fourth quarter.

Road fuel demand

Rystad forecasts that total global demand for road fuels will rise by 9 per cent in 2021, to 45.1 million bpd, from 41.3 million bpd in 2020.

Road fuel demand is expected to accelerate in 2022 to about 47.5 million bpd.

In April, road fuel demand is anticipated to average 44.2 million bpd globally, rising to 44.9 million bpd in May and 45.9 million bpd in June.

Further ahead, road fuel demand is expected to average 46.2 million bpd in the third quarter and 46.5 million bpd in the fourth quarter.

Jet fuel demand

Among the various fuel sectors, jet fuel has been hit the hardest by the pandemic.

Rystad Energy expects jet fuel demand to average 3.9 million bpd in 2021, rising by 21 per cent from 3.2 million bpd last year, but still a far cry from pre-pandemic levels.

Most of the recovery is expected during 2022, when jet fuel demand is expected to average 5.4 million bpd as air traffic returns to more normal levels.

Jet fuel demand in April is set to reach 3.4 million bpd, rising to 3.6 million bpd in May and 3.9 million bpd in June.

Further ahead, jet fuel demand is expected to average 4.3 million bpd in the third quarter and 4.6 million bpd in the fourth quarter.

Regional demand figures

Total oil demand in the United States is now forecast to average at 19.4 million bpd in 2021, an 8 per cent increase from 18.1 million bpd last year.

In 2022, U.S. oil demand is expected to climb to 20.0 million bpd.

Oil demand for the current month of April is forecast at 18.8 million bpd, rising to 19.1 million bpd in May and 19.6 million bpd in June.

Further ahead, oil demand is expected to average 19.9 million bpd in the third quarter and 20.2 million bpd in the fourth quarter.

U.S. road fuel demand is forecast to recover to 11.8 million bpd in 2021, a 10 per cent rise from last year’s 10.7 million bpd.

In 2022, Rystad forecasts road fuel demand to increase to about 12.2 million bpd.

Road fuel demand in April is expected at 11.6 million bpd, rising to 11.9 million bpd in May and 12.1 million bpd in June.

Further ahead, road fuel demand is expected hold steady at about 12.2 million bpd in both the third quarter and the fourth quarter.

Total oil demand in Europe is now forecast to average 13.4 million bpd in 2021, a 6 per cent increase from 12.7 million bpd last year.

In 2022, European oil demand is expected to rise to 14.1 million bpd.

The monthly oil demand forecast for both April and May lies at 13.0 million bpd, climbing to 13.5 million bpd in June.

Further ahead, oil demand is expected to average 14.0 million bpd in both the third and fourth quarters this year.

European road fuel demand in 2021 is expected to recover to 6.6 million bpd, a 7 per cent rise from last year’s 6.1 million bpd.

In 2022, road fuel demand is forecast to rise to 6.7 million bpd.

Road fuel demand in April is forecast at 6.5 million bpd, nudging up to 6.6 million bpd in May and 6.9 million bpd in June.

Further ahead, road fuel demand in the third quarter is expected to average 7.0 million bpd before dipping to 6.8 million bpd in the fourth quarter.

Total oil demand in China is now forecast to average at 14.9 million bpd this year, a 7 per cent increase from 13.9 million bpd last year.

In 2022, Rystad anticipates Chinese oil demand to rise further to 15.8 million bpd.

April oil demand is forecast at 14.8 million bpd, climbing to 14.9 million bpd in May and 15.1 million bpd in June.

Further ahead, oil demand is expected to average 14.9 million bpd in the third quarter and rise to 15.3 million bpd in the fourth quarter.

Chinese road fuel demand in 2021 is projected to recover to 6.2 million bpd, an 11 per cent rise from 5.6 million bpd last year.

In 2022, road fuel demand is expected to increase to 7 million bpd.

Road fuel demand in both April and May is forecast at 6.1 million bpd, rising to 6.3 million bpd in June.

Further ahead, road fuel demand is expected to average 6.3 million bpd in the third quarter and 6.4 million bpd in the fourth quarter.

Other report findings

Aside from energy-related projections, the COVID-19 report also includes general estimates regarding the spread and development of the pandemic globally, including forecasts regarding how the virus will evolve in the most affected countries.

Rystad’s numbers are adjusted monthly to take into account all significant steps taken by governments to fight the coronavirus pandemic.

The latest updated version of the report is publicly accessible by clicking here or by visiting here: www.rystadenergy.com/newsevents/news/press-releases/rystad-energys-covid-19-report

Please note that some historical numbers may differ from month to month as governments revise their official figures.