The global lockdown to contain the coronavirus pandemic has led to low oil and gas demand and a decline in global energy prices. Against this backdrop, last year several companies in the Asia-Pacific (APAC) region realigned their capital spending, which lead to delays in some pipeline and liquefied natural gas (LNG) projects in the region, GlobalData has found. Additionally, reduced LNG imports from some of the key consumers such as Japan, China and India have further dented the growth of the midstream sector in the region.

Oil and Gas Analyst at GlobalData, Haseeb Ahmed, commented that the rising ambiguity around the current economic scenario is deterring prospective investors.

“One of the go-to strategies for several LNG operators has been downsizing the overall capital expenditure (capex) for 2020. For example, Woodside’s decision to cut the planned total capex in 2020 has led to a delay in final investment decisions (FIDs) on Pluto Train 2 LNG, Browse–North West Shelf pipeline and Scarborough–Pluto pipeline developments in Australia. Withdrawing the capex plans ensured that these companies had sufficient working capital, but it might dent their profitability in the long run,” Mr Ahmed said.

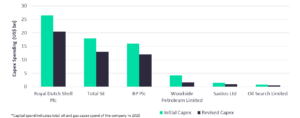

Capital spend* guidance of select Midstream operators, 2020. Image source: GlobalData Oil and Gas Intelligence Center.

Major pipeline and LNG operators have reported that their year-on-year financial performances have been hit in 2020.

Consequently, midstream operators such as Royal Dutch Shell Plc, Total SE and BP Plc have reduced their capex by more than 20 per cent to ensure steady cash flows.

Mr Ahmed added that the oil and gas sector has undergone significant losses, pushing companies to take desperate measures such as reducing capex or delaying FIDs.

However, on the brighter side, he noted that the global LNG supply glut along with low LNG prices will encourage new countries such as Myanmar, Vietnam and Sri Lanka to speed up LNG importing infrastructure.

“These new entrants will possibly contribute to the future LNG industry growth in the APAC,” Mr Ahmed said.