The oil and gas contracts market experienced significant turbulence in the first quarter of 2024, with the disclosed contract value plummeting by a staggering 37 per cent quarter-on-quarter (QoQ), according to a new report from GlobalData.

The report, titled Oil and Gas Industry Contracts Review by Sector, Region, Terrain, Planned and Awarded Contracts and Top Contractors and Issuers, Q1 2024, reveals that the total disclosed contract value dropped from $50.2 billion in Q4 2023 to $31.4 billion in Q1 2024.

This decline was accompanied by a decrease in overall contract volume, which fell from 1,346 in Q4 2023 to 1,142 in Q1 2024.

Pritam Kad, Oil and Gas Analyst at GlobalData, attributes this downturn to concerns over the demand outlook in oil and gas-consuming countries amid the looming recession and high inflation.

“Many traditional oil and gas industry projects are getting delayed or postponed due to concerns over demand outlook in oil and gas consuming countries amid the looming recession and high inflation, which is clearly evidenced by the decrease in both contract value and volume,” Kad commented.

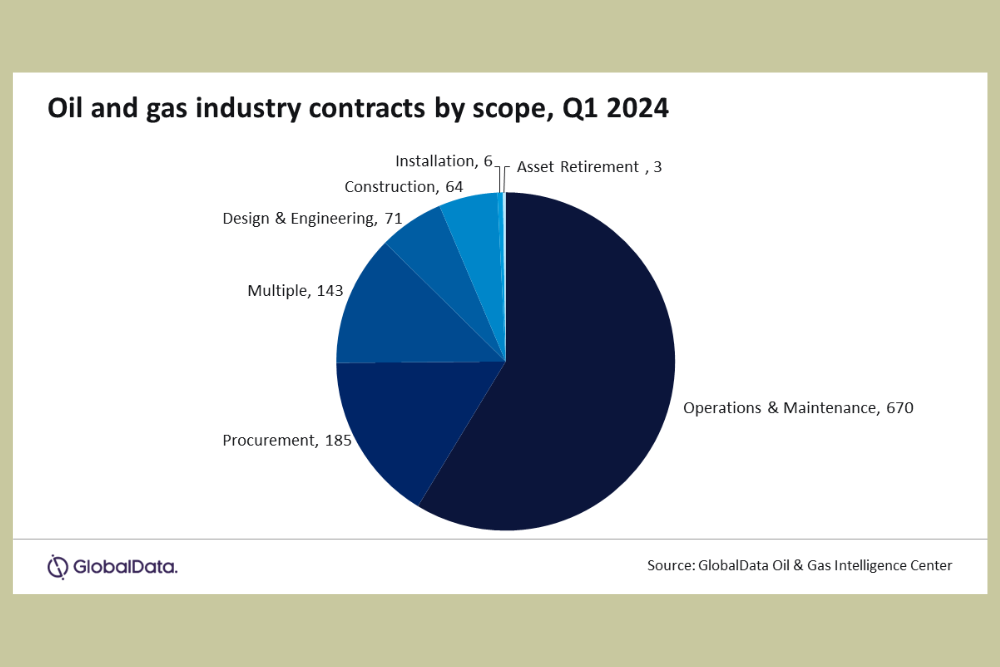

The report further reveals that Operation and Maintenance (O&M) contracts represented 59 per cent of the total contracts in Q1 2024, followed by procurement scope with 16 per cent, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement accounted for 13 per cent.

Despite the overall decline, the quarter witnessed some notable contracts, including:

- Samsung Heavy Industries’ $3.44 billion construction contract for 15 LNG carriers, each with a capacity of 174,000 m3.

- Tecnicas Reunidas and Sinopec Engineering Group’s two lumpsum contracts worth approximately $3.3 billion from Saudi Aramco for the Engineering, Procurement, and Construction (EPC) of the Riyas Natural Gas Liquids (NGL) fractionation facility in Saudi Arabia.

- Tecnimont’s approximately $1.1 billion contract from Sonatrach for the Engineering, Procurement, Construction, and Commissioning (EPCC) of a new Linear Alkyl Benzene (LAB) plant with a capacity of 100,000 tons per annum (tpa) and utilities infrastructure in east Algeria.

Despite the current challenges, Kad remains optimistic about the mid-term prospects for the industry.

“Contrarily, oil prices are anticipated to be favourable for producers due to potential supply disruptions arising from geopolitical risks. GlobalData expects that delayed or near-completion projects are likely to be pushed forward in the mid-term,” he concludes.

As the global economy navigates through uncertain times, the oil and gas industry will closely monitor market conditions and adjust its strategies accordingly.